|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

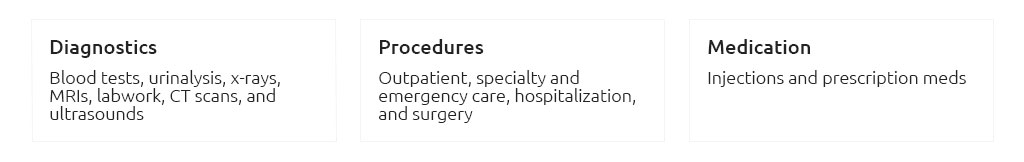

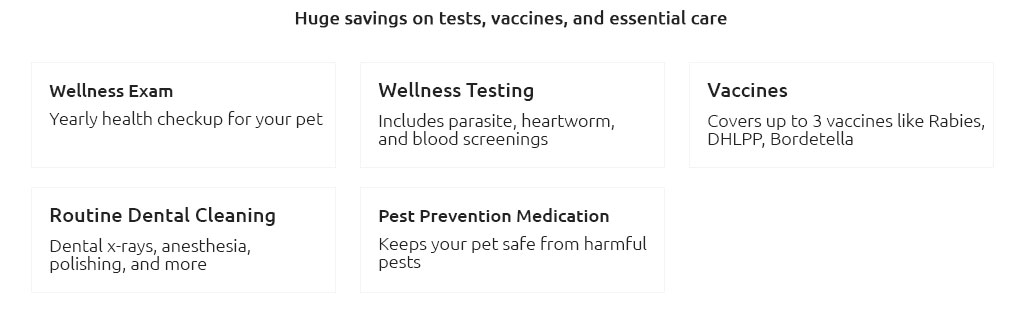

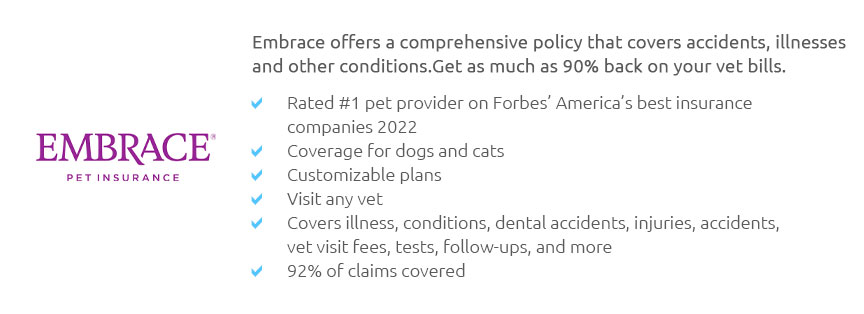

pet insurance knoxville: advanced, local insight for smarter coverageWhy your Knoxville address changes the calculusYou face a mix of Appalachian trail mishaps, long humid summers, and a dense tick and mosquito season along the Tennessee River. That means higher odds of knee injuries from hill runs, allergy workups in spring, and heartworm prevention failures. Local fees are moderate compared to big metros, but emergencies still bite: an after-hours exam can run a few hundred dollars before diagnostics; orthopedic repairs often land in the several-thousand range. Real moment, real mathYou're at Ijams close to dusk; your dog missteps near the river rocks and won't weight-bear. The emergency clinic quotes exam and X-rays, then recommends rest - or surgery next week. Total across the episode: roughly $4,200. With a policy set at a $500 annual deductible, 80% reimbursement, and a $10,000 annual limit, your covered cost becomes $4,200 minus $500 = $3,700; reimburse 80% → $2,960 back to you. Net out-of-pocket for the claim is $1,240, plus your yearly premium. It doesn't erase the bill, but it keeps the decision squarely about care rather than cash flow. Coverage design that matters more than logos

Local practicalitiesMost Knoxville clinics ask you to pay upfront; reimbursement follows once you submit the itemized invoice. A few offices will coordinate "direct pay" if your insurer supports it and the case is pre-authorized, but treat that as a bonus, not a baseline. The UT Veterinary Medical Center is thorough with documentation, which helps claims; still, pre-approval for big procedures can smooth the process. Advanced evaluation steps

Quick worksheet you can reuse

What "good value" looks like hereClarity beats perks. I'd favor an annual deductible, 80% reimbursement, and at least a $10k annual cap if your pet is active outdoors. Add dental illness and rehab if budget allows. If your pet is older or already has joint issues, prioritize a plan that continues chronic conditions into future years without resetting exclusions. Red flags that deserve a pause

If you're still weighing optionsRequest sample policies for two or three plans, plug your own numbers into the worksheet, and make one call to your primary vet to ask which benefits clients use most. You'll see patterns. Your choice doesn't have to be final - coverage can evolve as your pet's life does, and Knoxville's needs shift a bit across seasons.

|